It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing homeownership as a way to build their wealth, but it may not be exactly the way previous generations have done it. The study explains how […]

Read More

If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for. While the millennial generation has been dubbed the renter generation, that namesake may not be […]

Read More

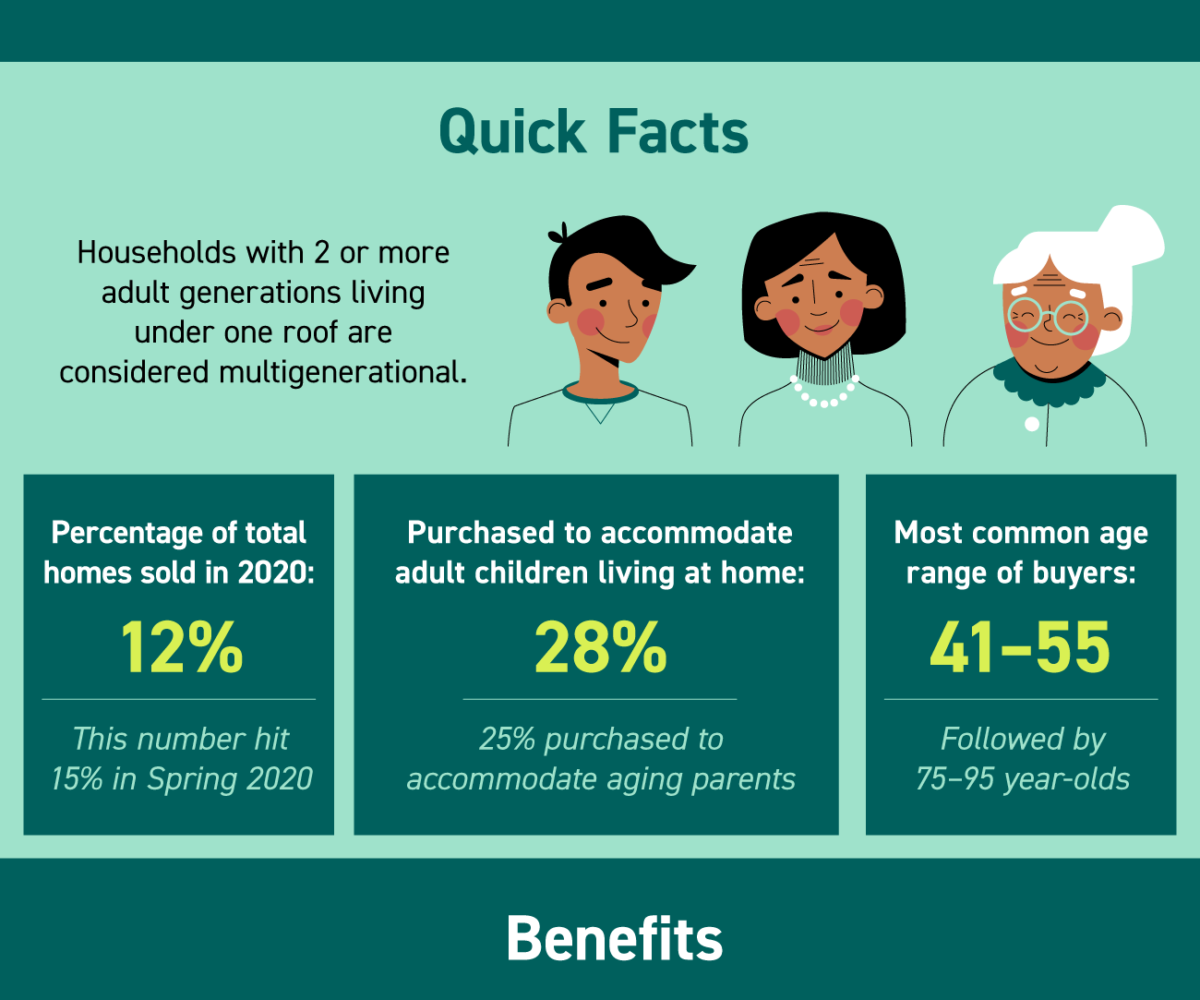

Some Highlights If you have additional loved ones coming to live with you but don’t have enough space, it may be time to consider a larger, multigenerational home. Some key benefits of multigenerational living include a combined homebuying budget, shared caregiving duties, enhanced relationships, and more. These benefits might be why more people are choosing […]

Read More

If you’re a millennial, homebuying might be top of mind for you. Your generation is the largest group of homebuyers in the market today and has been since 2014, according to the National Association of Realtors (NAR). And while other millennials are looking to buy for the first time, you may be one of the […]

Read More

The sense of pride you’ll feel when you purchase a home can’t be overstated. For first-generation homebuyers, that feeling of accomplishment is even greater. That’s because the pride of homeownership for first-generation buyers extends far beyond the homebuyer. AJ Barkley, Head of Neighborhood and Community Lending for Bank of America, says: “Achieving this goal can […]

Read More

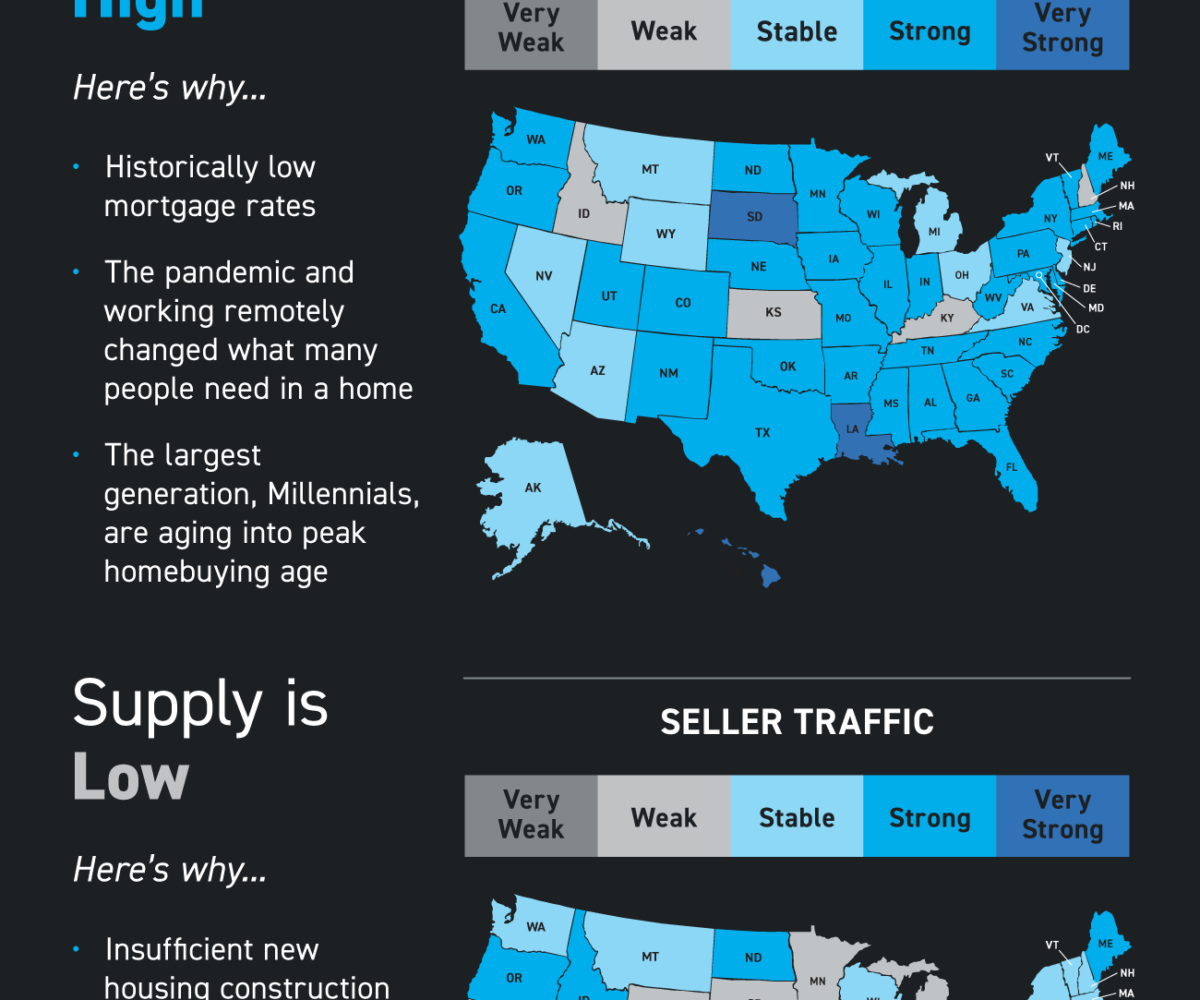

Some Highlights Today’s strong sellers’ market is the direct result of high demand and low supply. Low mortgage rates and generational trends have created an increased demand for homes. Meanwhile, the slower pace of new home construction and homeowners staying in their homes longer have both led to today’s low supply. If you’re thinking of […]

Read More

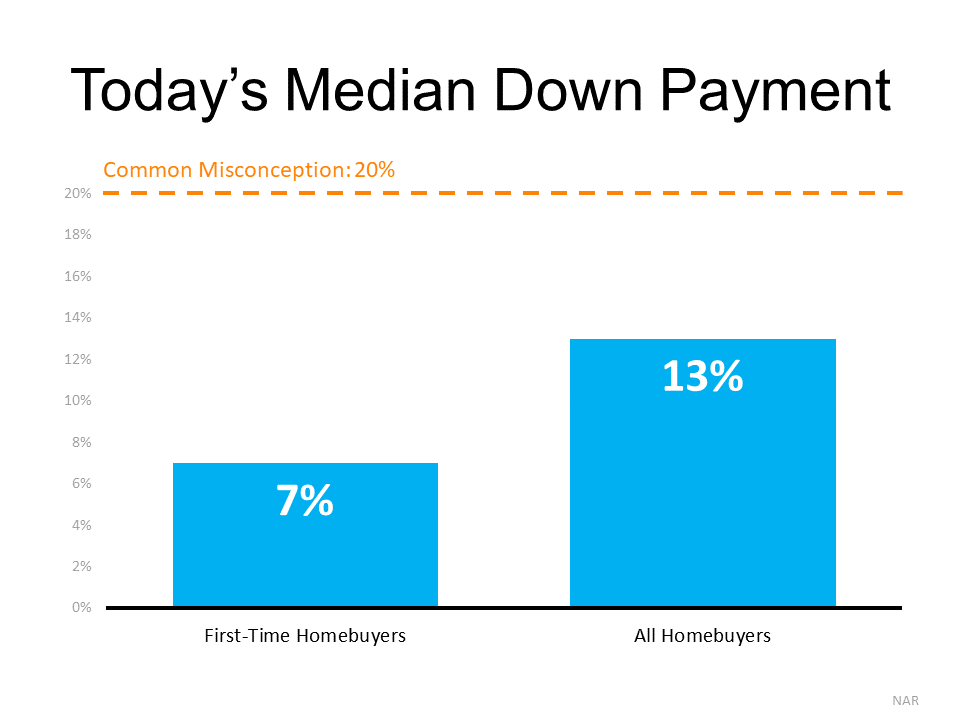

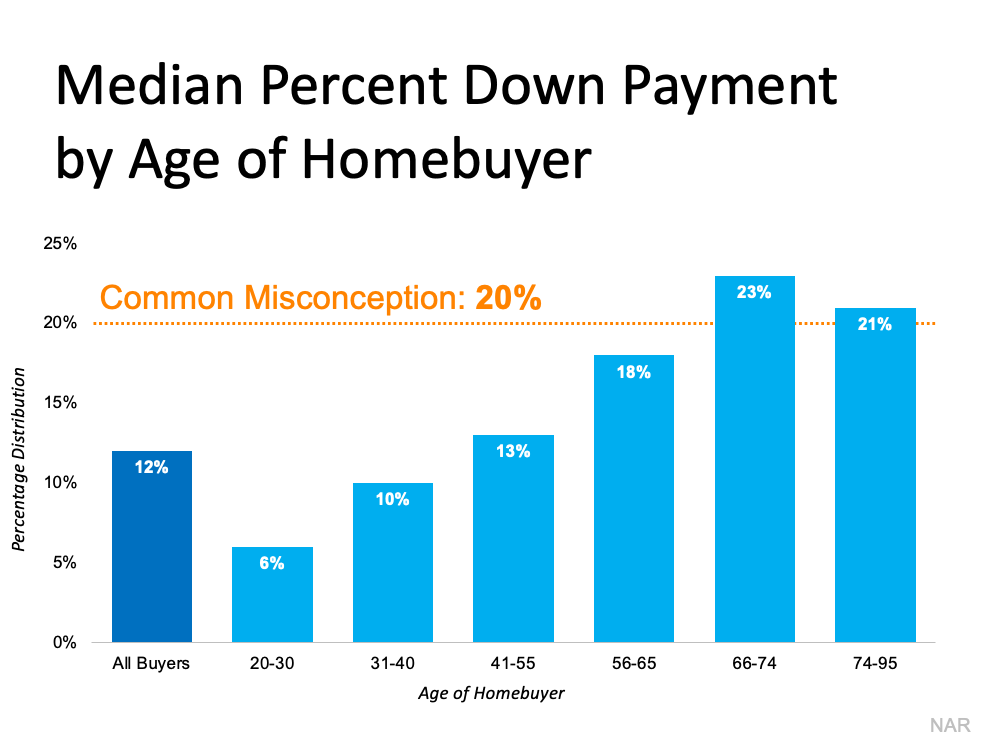

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is […]

Read More

There’s a common misconception that younger generations aren’t interested in homeownership. Many people point to the fact that millennials put off purchasing their first home as a reason for this belief. Odeta Kushi, Deputy Chief Economist for First American, explains why millennials have put off certain milestones linked to homeownership. Those delays led to their […]

Read More

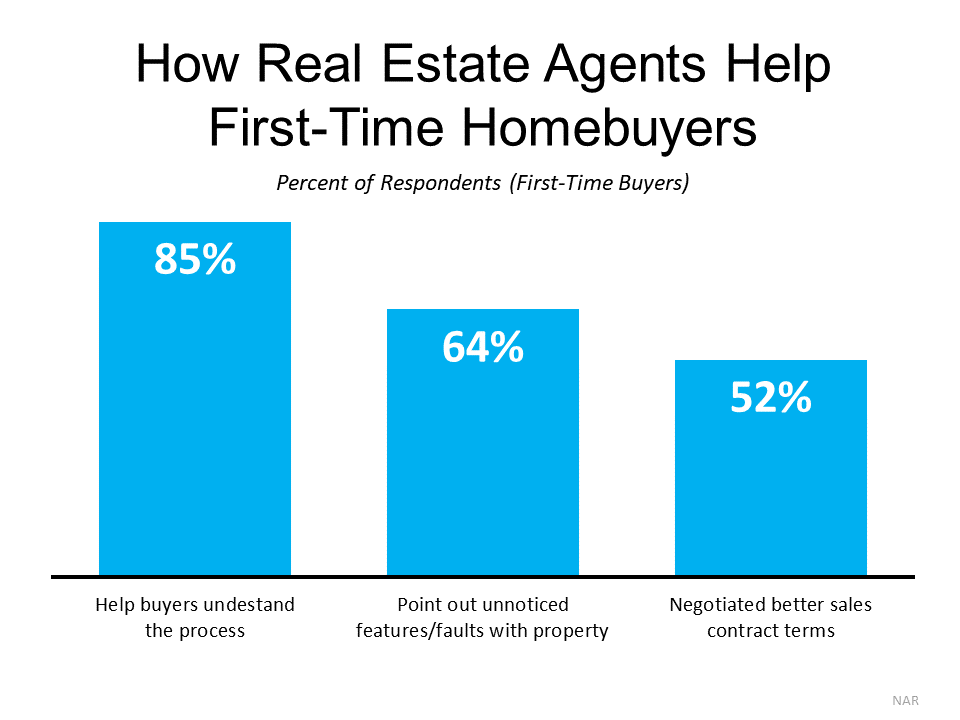

For many young or first-time homebuyers, purchasing a home can feel intimidating. A recent survey shows some homebuyers ages 25 to 40 may be unsure about the homebuying process and what they can afford. It found: “1 in 4 underestimated their buying potential by $150k or more” “1 in 4 underestimated the increase in value […]

Read More

Some Highlights If your house is feeling a little cramped with the addition of adult children or aging parents, it might be time to consider a move-up into a multigenerational home that better suits your changing needs. With benefits that include a combined homebuying budget and shared caregiving duties, an increasing number of households are […]

Read More