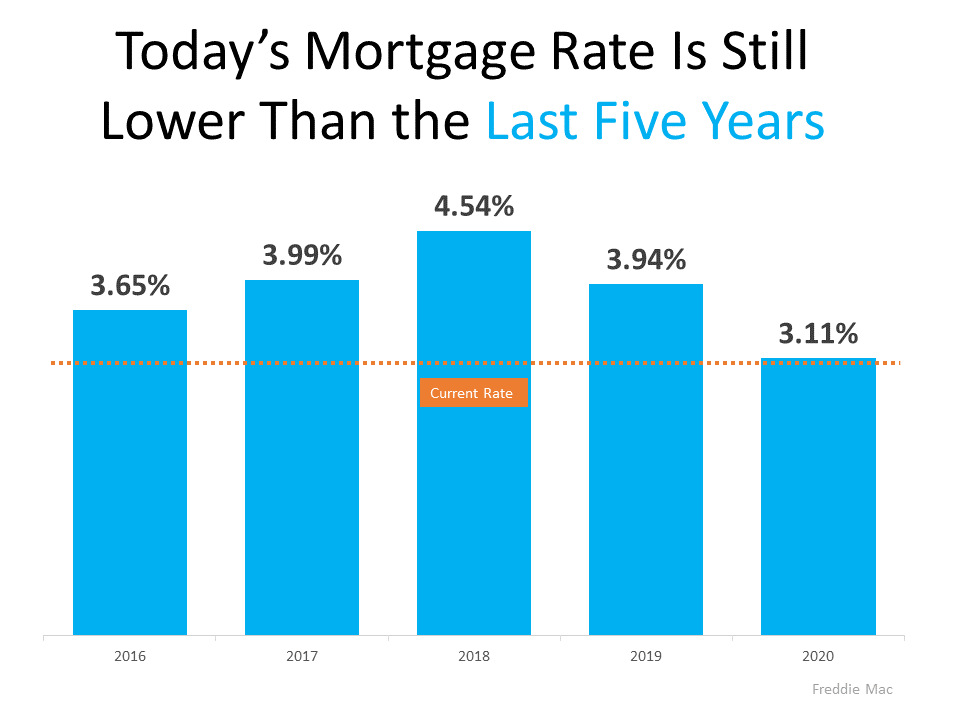

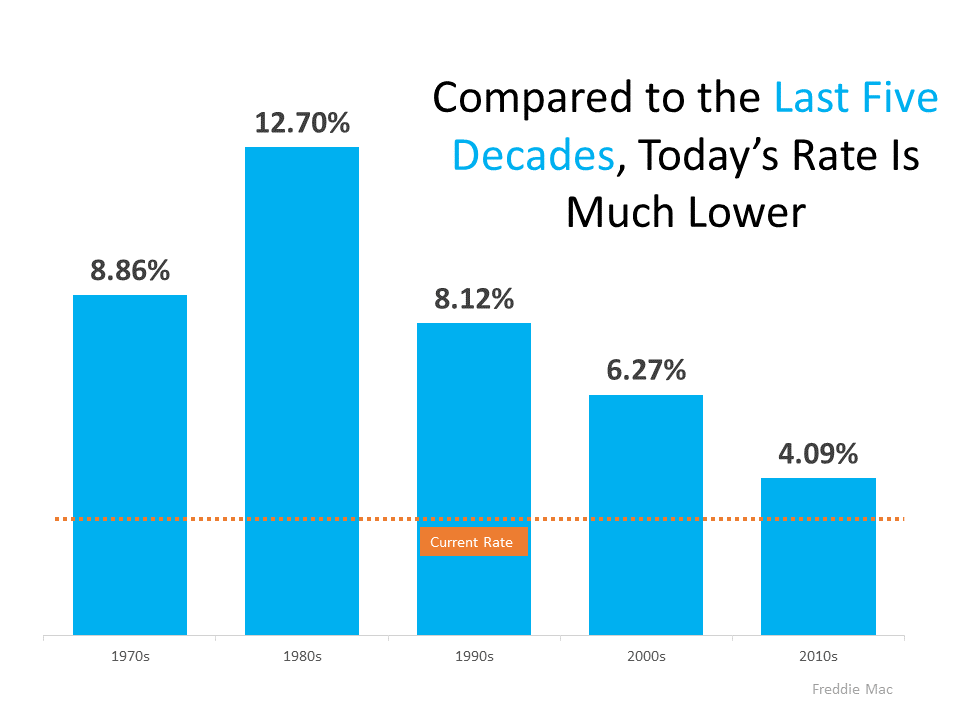

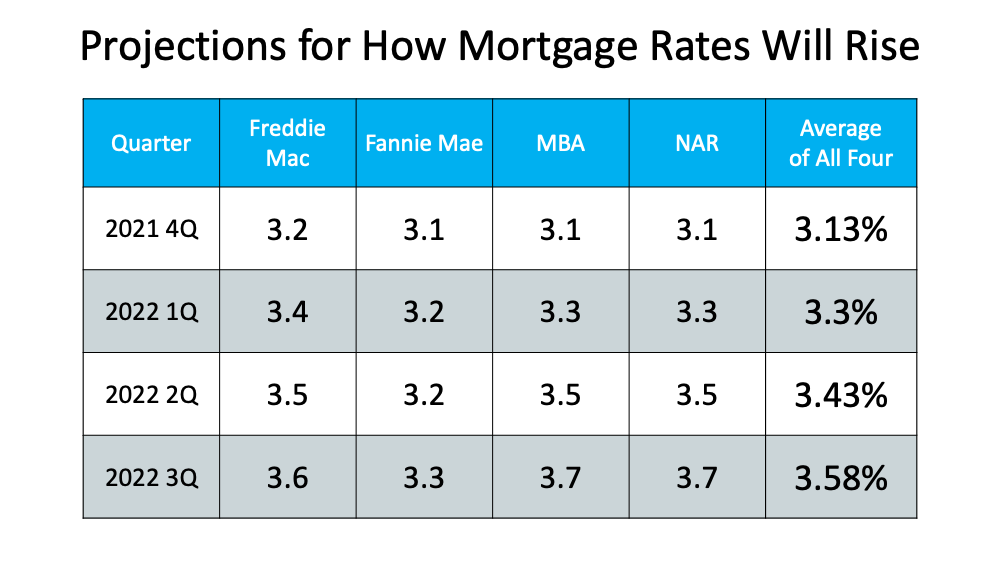

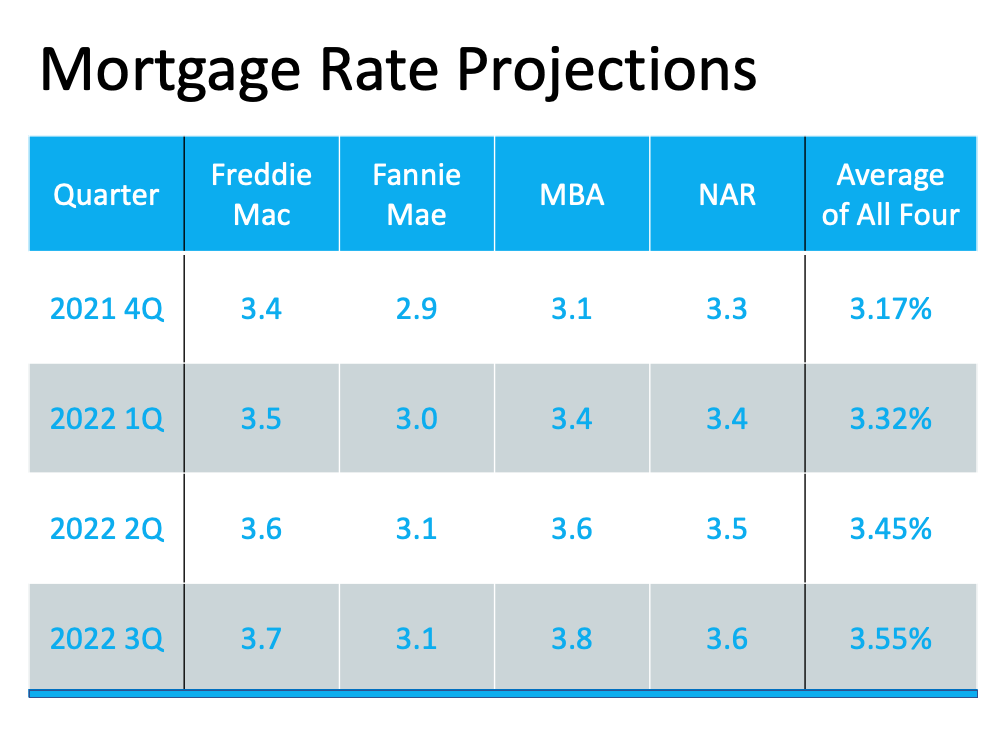

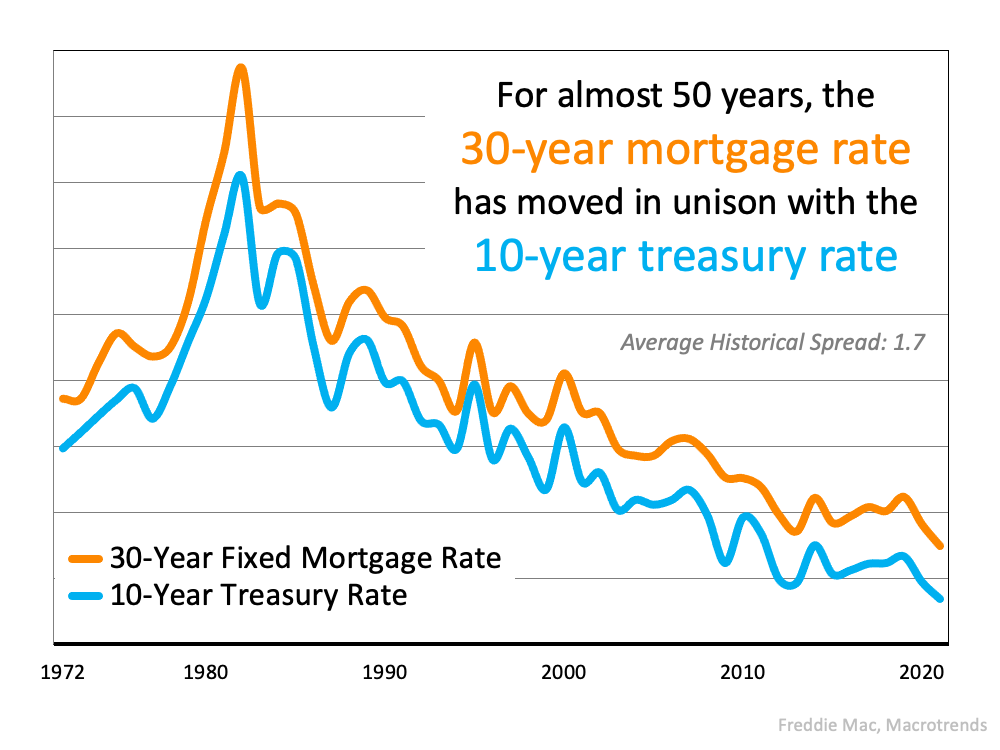

With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since experts project rates will rise further in the coming months, that conversation isn’t going away any time soon. But as a homebuyer, what do rates […]

Read More

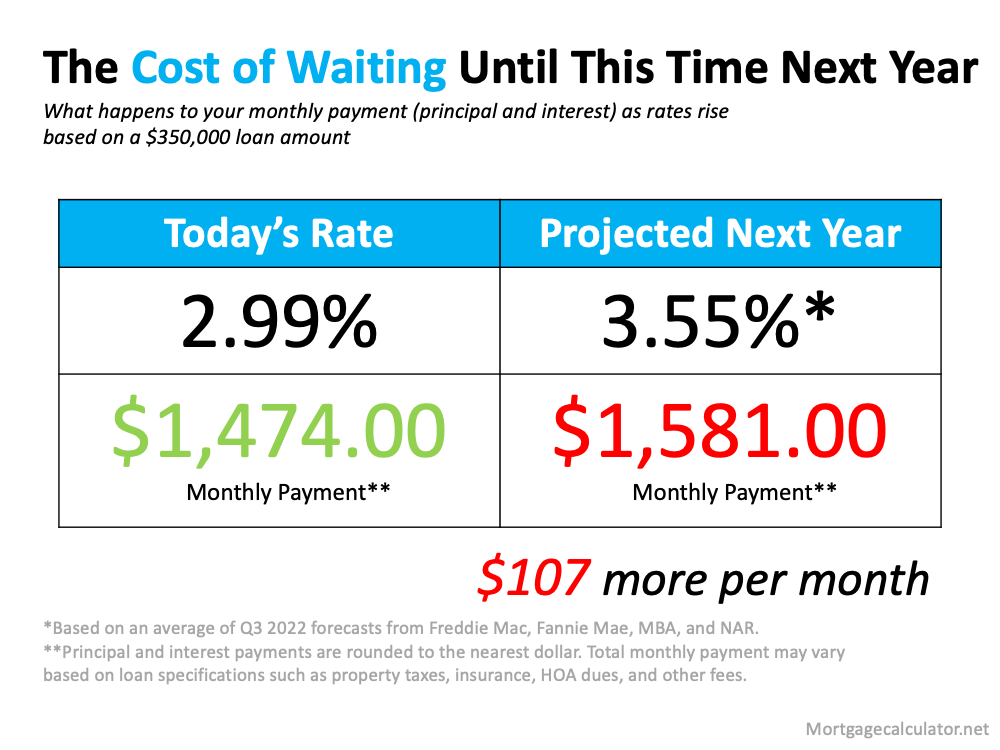

Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates have hit the lowest point ever recorded, and they’ve hovered in the historic-low territory. But even over […]

Read More

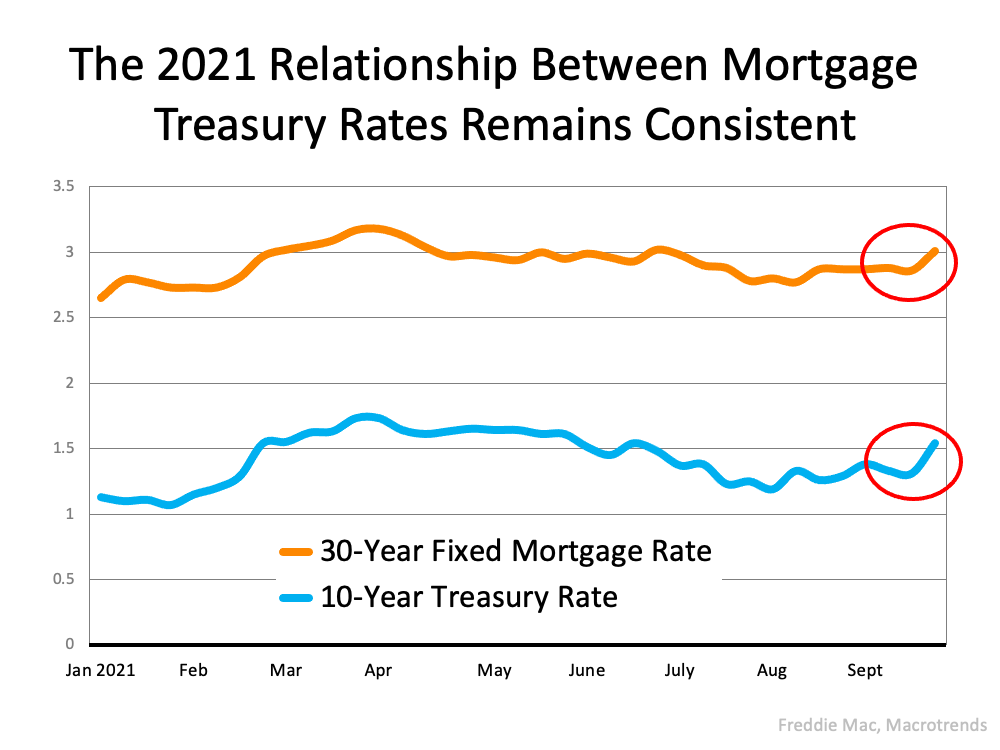

With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), puts it best, saying: “Housing demand remains strong as buyers likely want to secure a home […]

Read More

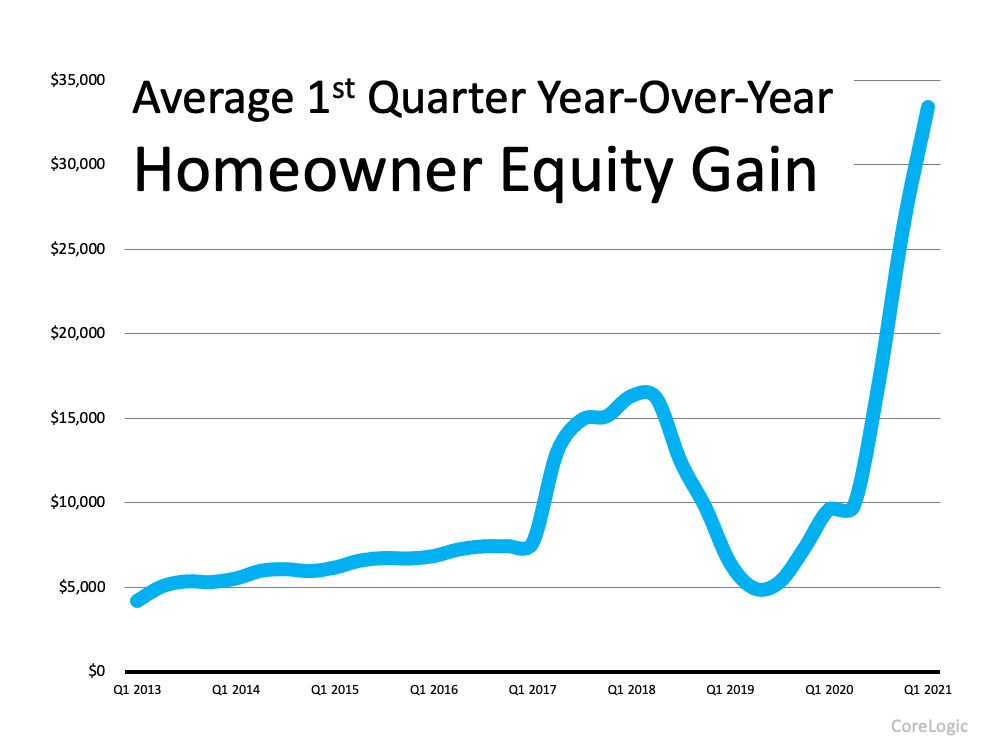

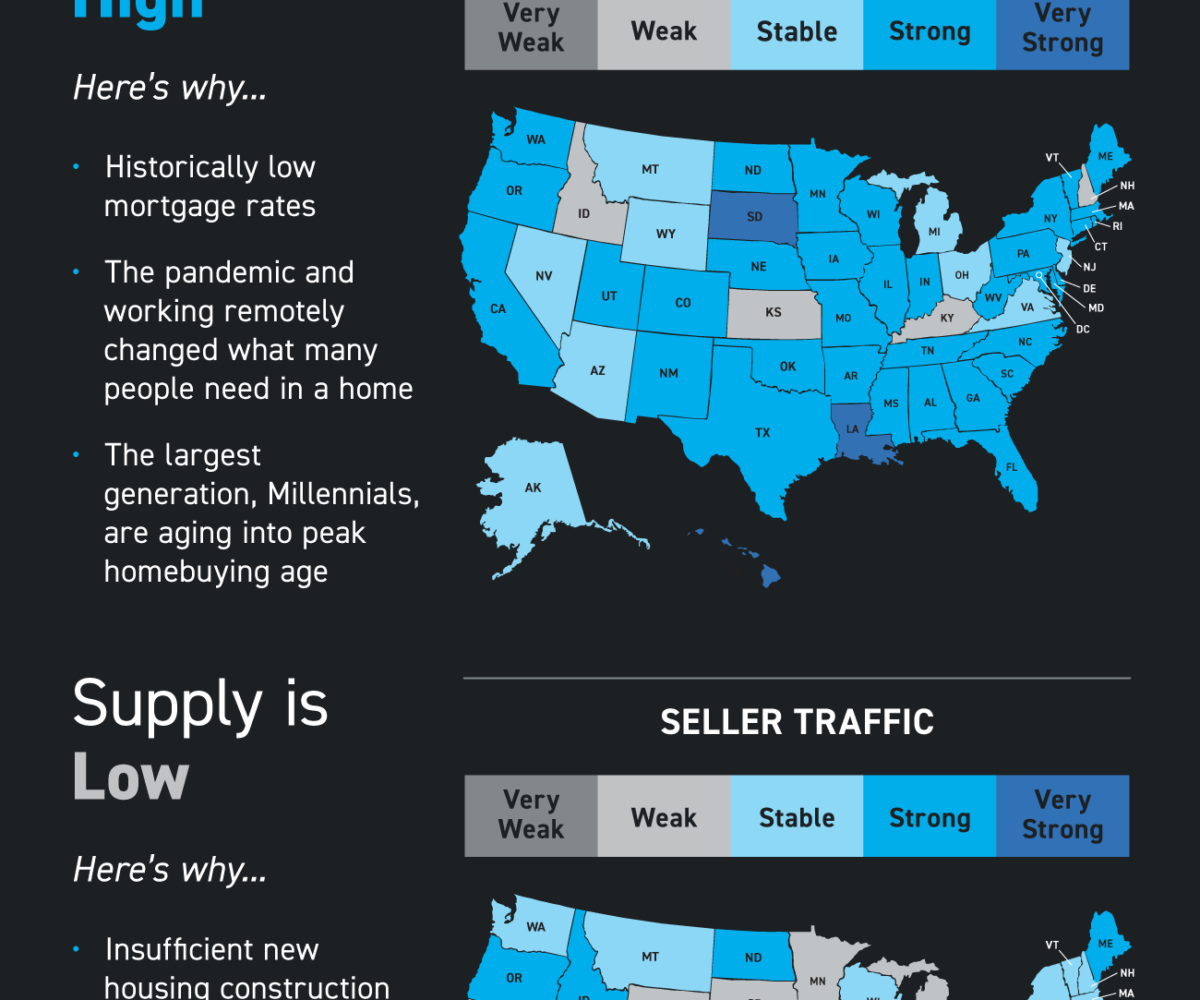

The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced historically. There are many reasons for the limited number of homes on the market, but as you can see […]

Read More

The last 18 months changed what many buyers are looking for in a home. Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The survey reveals the following: 70% of respondents want more outdoor living space 69% of respondents want a home office (48% wanted multiple offices) […]

Read More

Today’s housing market is truly one for the record books. Over the past year, we’ve seen the lowest mortgage rates in history. And while those rates seemed to bottom out in January of this year, the golden window of opportunity for buyers isn’t over just yet. If you’re one of the buyers who worry they’ve […]

Read More

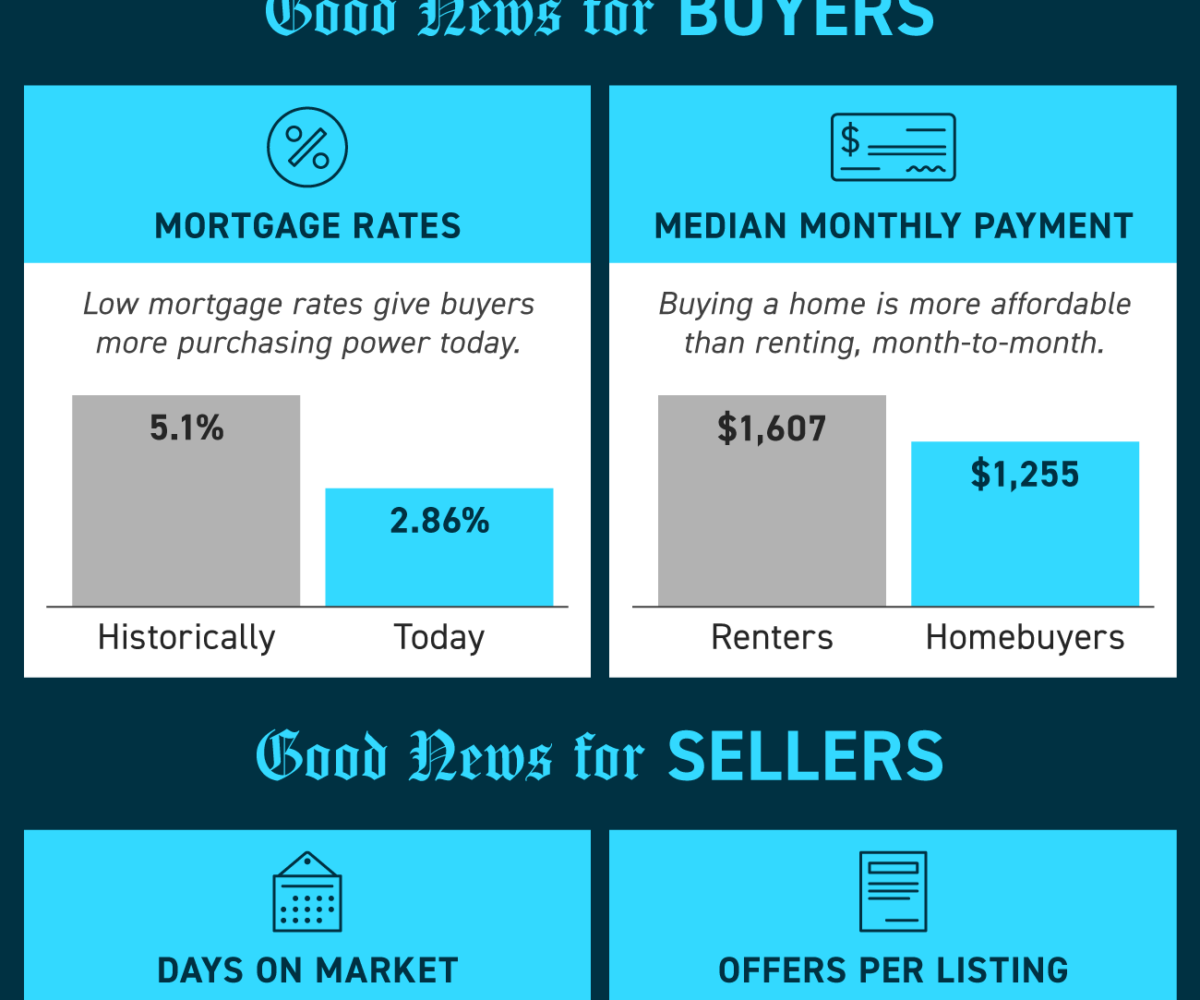

Some Highlights Today’s strong sellers’ market is the direct result of high demand and low supply. Low mortgage rates and generational trends have created an increased demand for homes. Meanwhile, the slower pace of new home construction and homeowners staying in their homes longer have both led to today’s low supply. If you’re thinking of […]

Read More

Every Thursday, Freddie Mac releases the results of their Primary Mortgage Market Survey which reveals the most recent movement in the 30-year fixed mortgage rate. Last week, the rate was announced as 3.01%. It was the first time in three months that the mortgage rate surpassed 3%. In a press release accompanying the survey, Sam […]

Read More

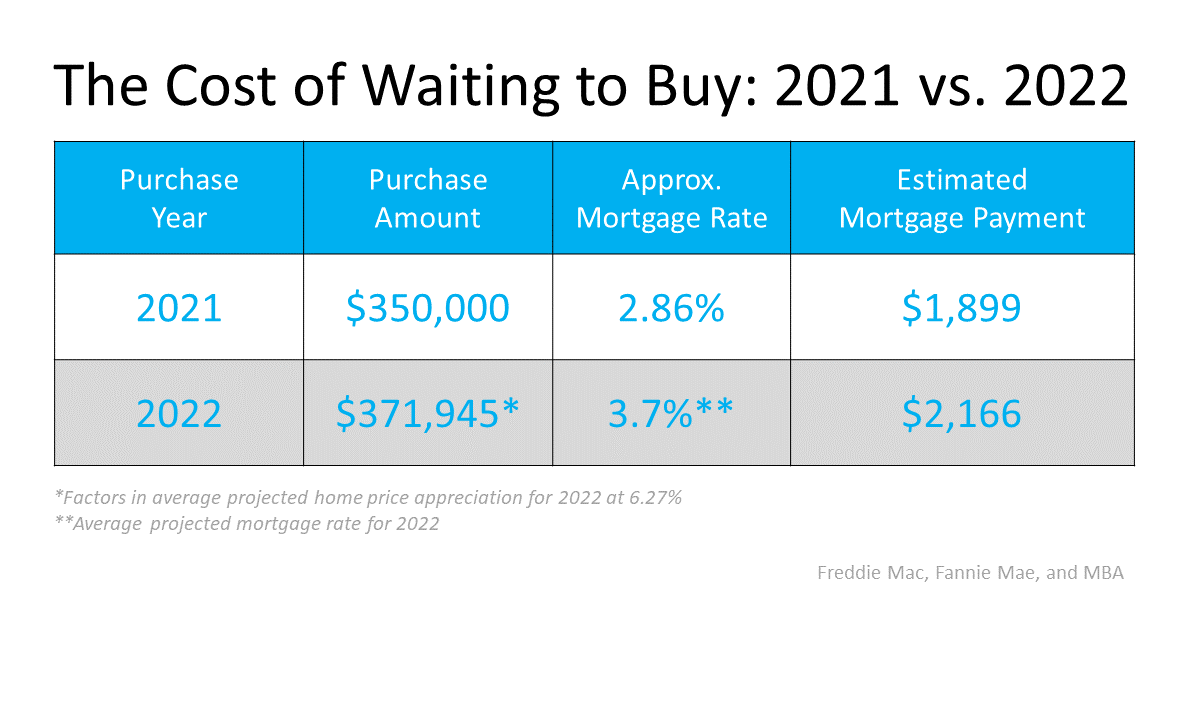

If you’re a renter with a desire to become a homeowner, or a homeowner who’s decided your current house no longer fits your needs, you may be hoping that waiting a year might mean better market conditions to purchase a home. To determine if you should buy now or wait, you need to ask yourself […]

Read More

Some Highlights Whether you’re buying or selling – today’s housing market has plenty of good news to go around. Buyers can take advantage of today’s mortgage rates to escape rising rents and keep monthly payments affordable. Sellers can reap the benefits of multiple offers and a fast sale. If this sounds like good news to […]

Read More