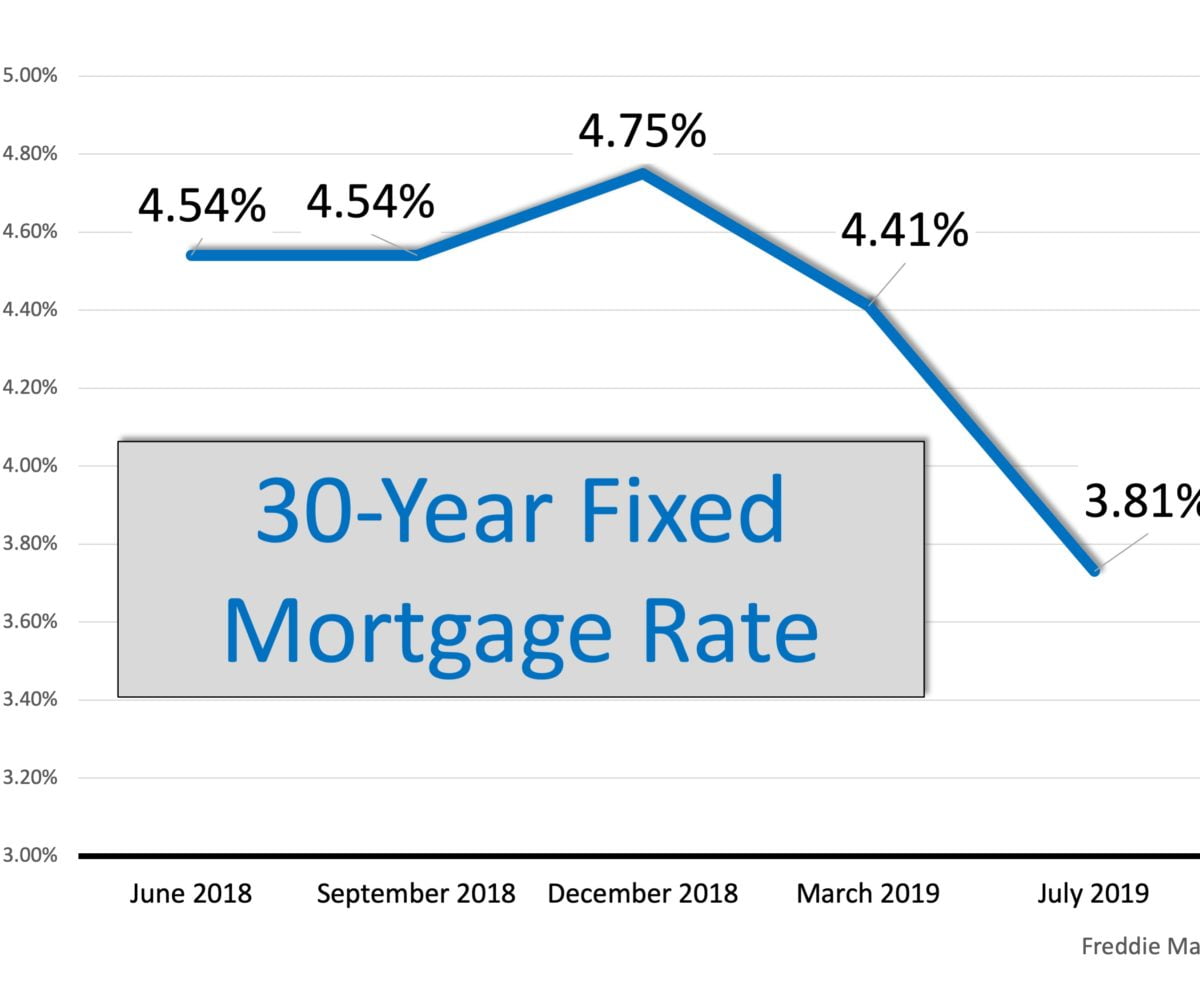

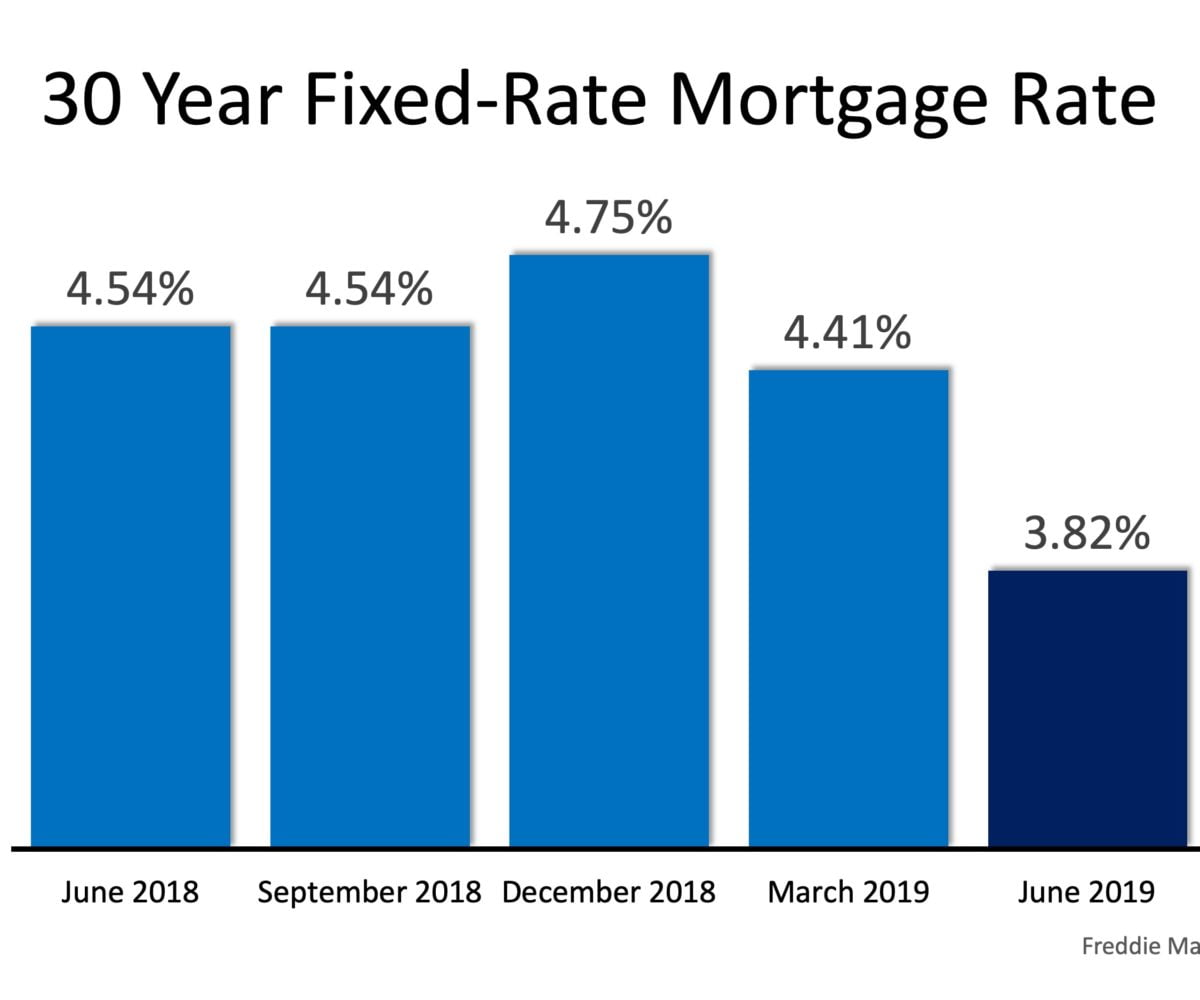

The gap between the increase in personal income and residential real estate prices has been used to defend the concept that we are experiencing an affordability crisis in housing today. It is true that home prices and wages are two key elements in any affordability equation. There is, however, an extremely important third component to […]

Read More

Price appreciation can differ depending on your price range. CoreLogic analyzed four individual home prices tiers and shares the increase in each one. CoreLogic’s Home Price Index (HPI) Report revealed, “National home prices increased 3.6% year over year in July 2019 and are forecast to increase 5.4% from July 2019 to July 2020.” They also […]

Read More

We’re in the back half of the year, and with a decline in interest rates as well as home price and wage appreciation, many are wondering what the predictions are for the remainder of 2019. Here’s what some of the experts have to say: Ralph McLaughlin, Deputy Chief Economist for CoreLogic “We see the cooldown […]

Read More

The current housing landscape presents greater home values, low interest rates, and high buyer demand. All of these factors point to the strong market forecasted to continue throughout the rest of the year. There is, however, one thing that may cause the industry to tap the brakes: an overall lack of housing inventory. Buyer demand naturally increases […]

Read More

Whether you are a first-time buyer or looking to move up to the home of your dreams, now is a great time to purchase a home. Here are three major reasons to buy today. 1. Affordability Many people focus solely on price when talking about home affordability. Since home prices have appreciated throughout the […]

Read More

Shifting trends and industry-leading research are pointing toward some valuable projections about the status of the housing market for the rest of the year. If you’re thinking of buying or selling, or if you just want to know what experts are saying is on the horizon, here are the top three things to put on […]

Read More

We’re halfway through the year, and with a decline in interest rates as well as home price and wage appreciation, many are wondering what the experts predict for the second half of 2019. Here’s what some have to say: Danielle Hale, Chief Economist at realtor.com “Lower mortgage rates, higher wages and more homes for sale […]

Read More

With the recent lower interest rates, many homeowners are wondering if they should refinance. To decide if refinancing is the best option for your family, start by asking yourself these questions: Why do you want to refinance? There are many reasons to refinance, but here are three of the most common ones: Lower your interest […]

Read More

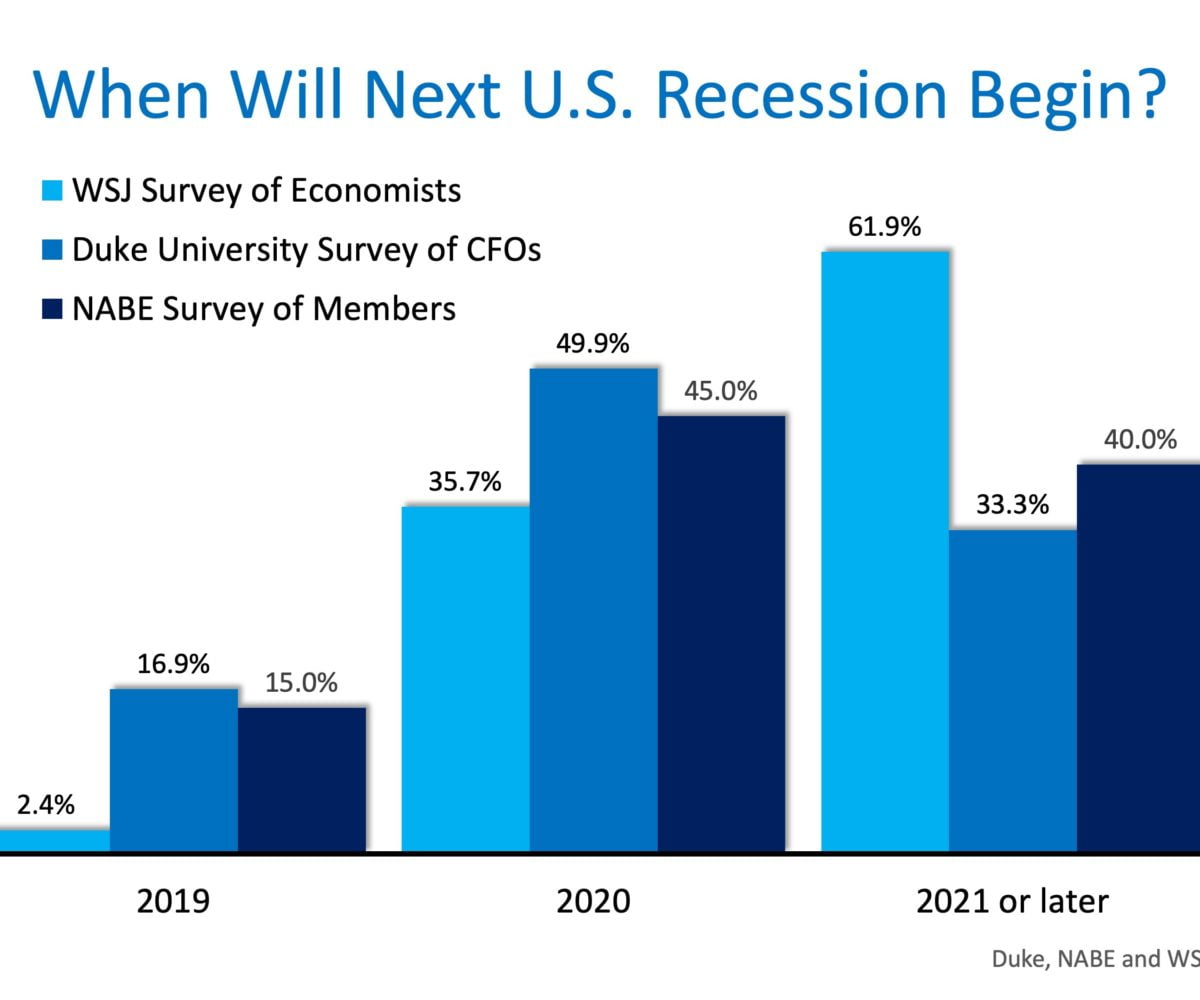

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet. The following three areas of the housing market are critical to understand: interest rates, building materials, […]

Read More

Here are four reasons to consider buying today instead of waiting. 1. Prices Will Continue to Rise CoreLogic’s latest U.S. Home Price Insights reports that home prices have appreciated by 3.7% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 4.8% over the next year. […]

Read More