Owning a home has great financial benefits. In a recent research paper, Homeownership and the American Dream, Laurie S. Goodman and Christopher Mayer of the Urban Land Institute explained: “Homeownership appears to help borrowers accumulate housing and nonhousing wealth in a variety of ways, with tax advantages, greater financial flexibility due to secured borrowing, built-in […]

Read More

Whether it is your first time or your fifth, it is always important to know all the facts when it comes to buying a home. With the large number of mortgage programs available that allow buyers to purchase homes with down payments below 20%, you can never have too much information about Private Mortgage Insurance (PMI). What […]

Read More

If you are in the market to buy a home this year, you may be confused about how much money you need to come up with for your down payment. Many people you talk to will tell you that you need to save 20% or you won’t be able to secure a mortgage. The truth […]

Read More

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state. Using data from HUD, Census and […]

Read More

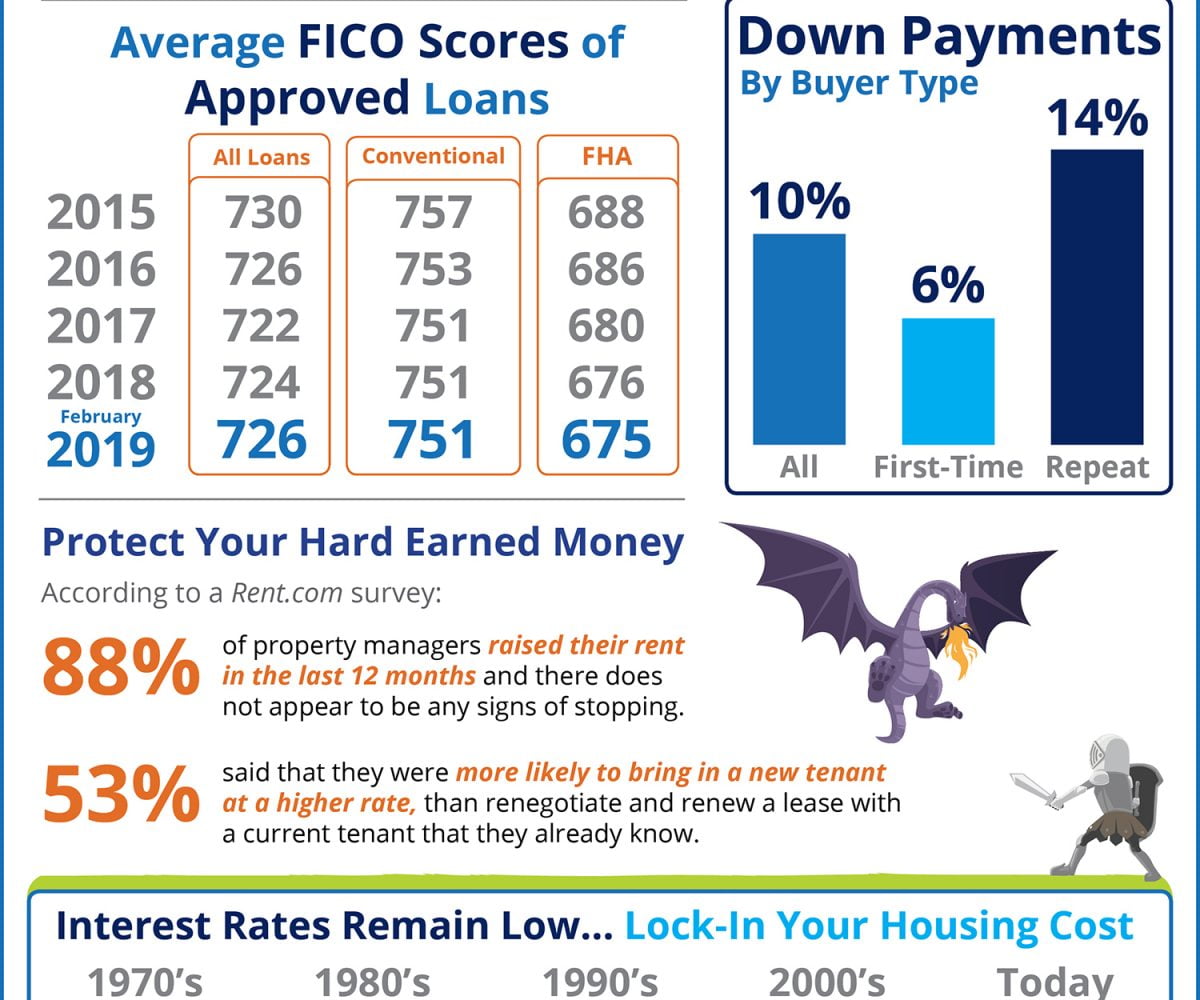

Some Highlights: The average down payment for first-time homebuyers is only 6%! Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate! 88% of property managers raised their rents in the last 12 months! The average credit score on approved loans continues to fall across many […]

Read More

According to data released by the Internal Revenue Service (IRS), Americans can expect an estimated average refund of $3,143 this year when filing their taxes. This is down slightly from the average refund of $3,436 last year. Tax refunds are often thought of as ‘extra money’ that can be used toward larger goals. For anyone looking to buy a […]

Read More

Some Highlights: Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking too much about it. Living within a budget right now will help you save money for down payments while also paying down other debts that might be holding you […]

Read More

The largest obstacle renters face when planning to buy a home is saving for a down payment. This challenge is amplified by rising rents, which has eaten into the amount of money renters have leftover for savings each month after paying expenses. In combination with higher rents, survey after survey has shown that non-homeowners (renters […]

Read More

Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership: Down Payment, Credit, and Affordability,” which revealed that, “Consumers often think they need to put more money down to purchase a home than is actually required. In a 2017 survey, 68% of renters cited saving for a down payment as an obstacle to homeownership. Thirty-nine percent of renters […]

Read More

Chances are if you are renting you are spending too much of your income on your monthly housing expense. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their rent or mortgage payment. This percentage allows the household to save money for the future while comfortably covering […]

Read More