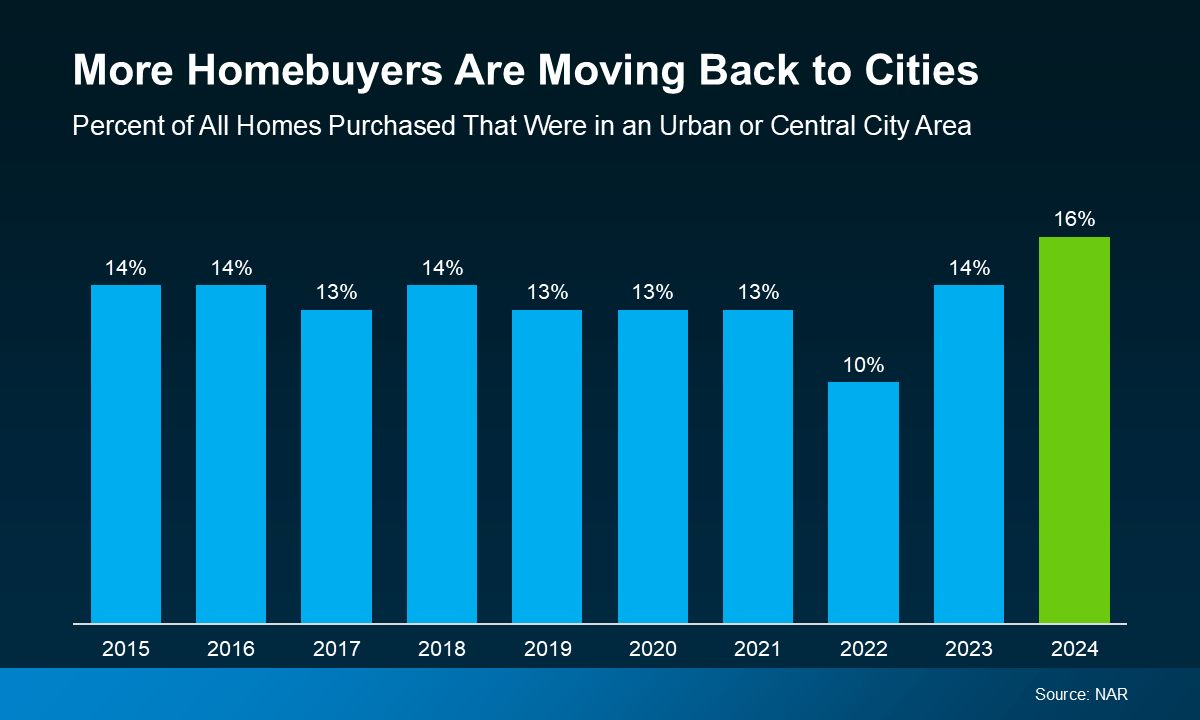

After years of suburban and rural migration during the pandemic, cities have been making a comeback in the past couple of years. According to the National Association of Realtors (NAR), the percentage of people moving to cities has risen to 16%. While that may not sound like a big number to you, it is the […]

Read More

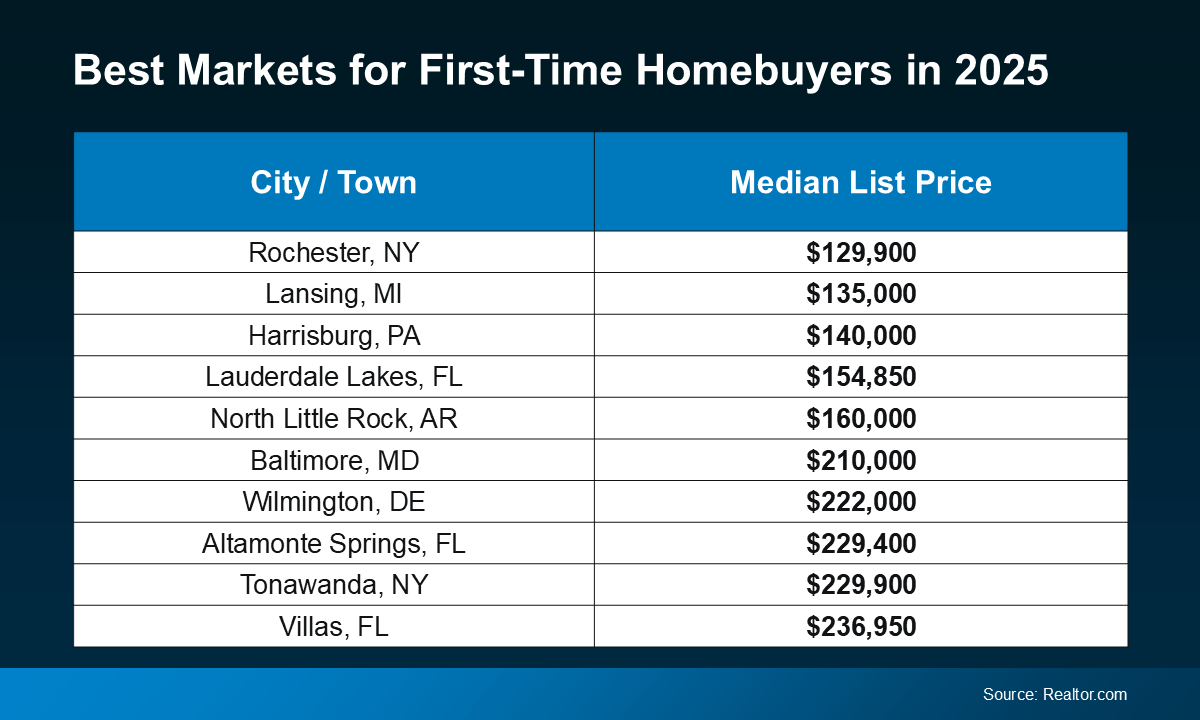

If you’re like a lot of aspiring homebuyers, there’s a major hurdle standing in your way — the cost of living. From groceries to gas, eggs, and just about everything else, prices have gone up. And that rings true for home prices, too. But even when everything feels expensive, there are still ways to make homeownership […]

Read More

Some Highlights You may be sitting on the sidelines wondering if it’s better to buy now or wait. But buying before the spring rush may be a game-changing decision. Moving this winter can give you significant advantages, like less competition, more negotiating power, and lower prices. If you’re able to buy now, stay ahead of […]

Read More

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner. If you’re willing to roll up your sleeves (or hire someone who will), buying a house that needs some work could open the door to homeownership. Here’s everything you […]

Read More

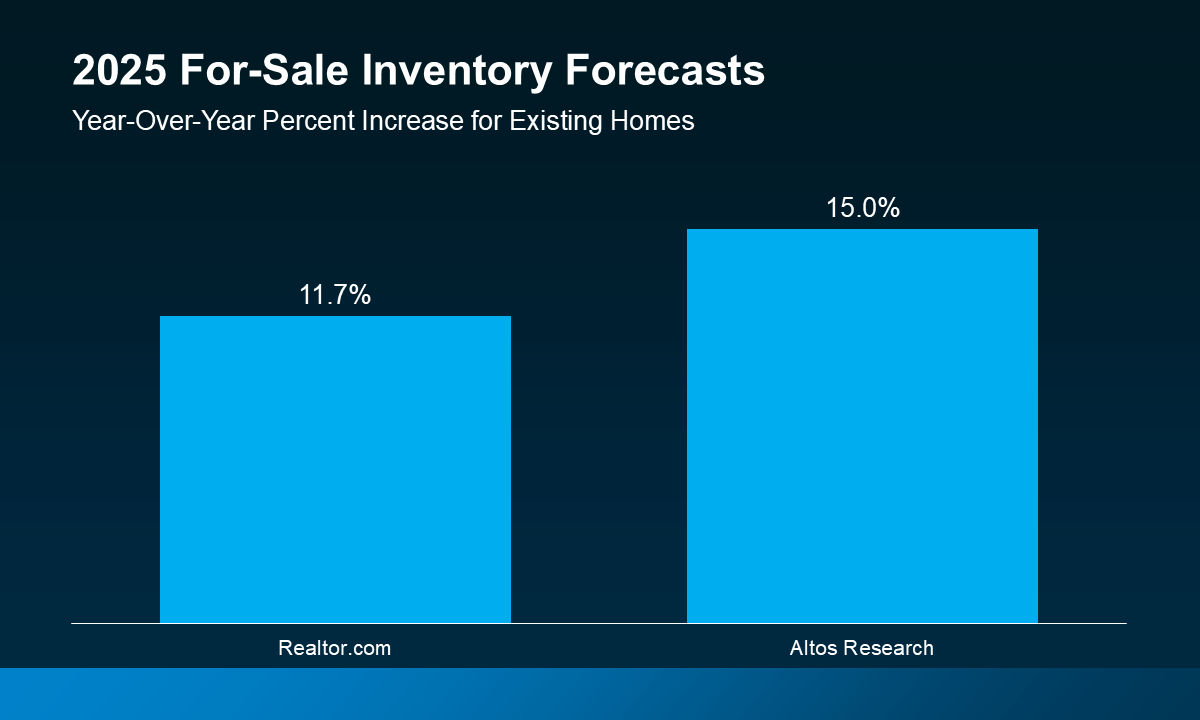

The past few years have been challenging for homebuyers, especially with higher home prices and mortgage rates. And if you’re trying to buy a home, it’s easy to worry you won’t be able to find something in your budget. But here’s what you need to know. The number of homes for sale has grown a […]

Read More

A recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s the thing. With the right resources and help, you can still make it happen. There […]

Read More

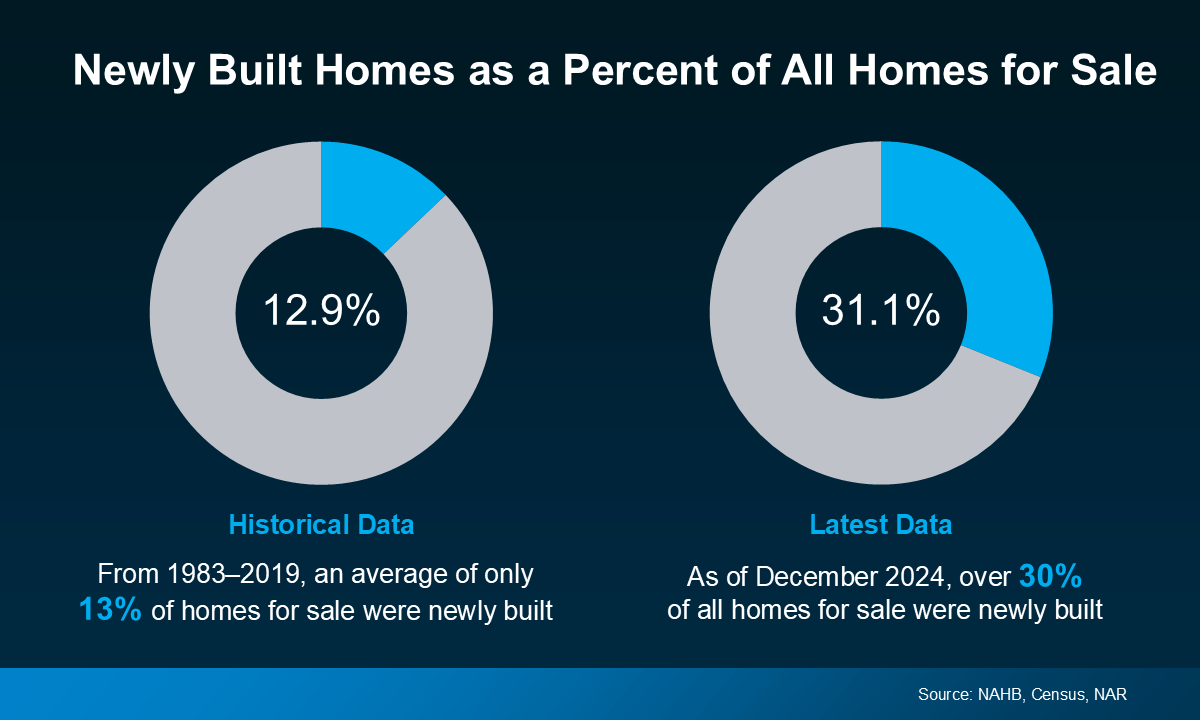

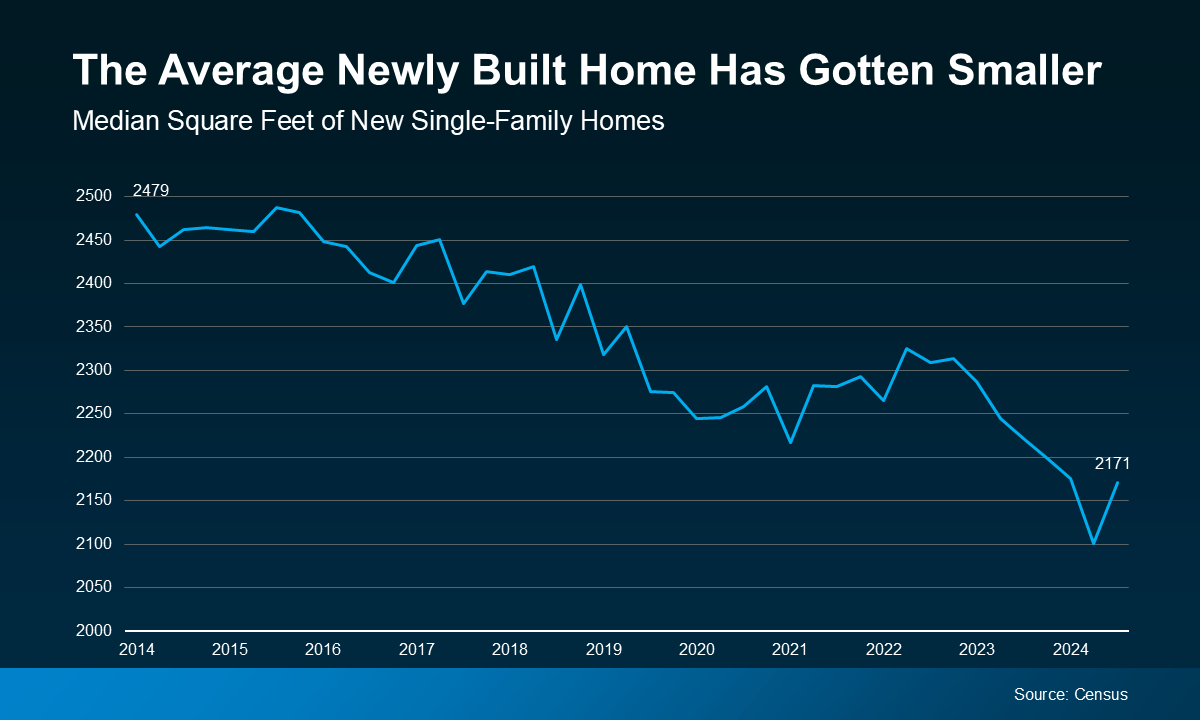

It’s no secret that affordability is tough with where mortgage rates and home prices are right now. And that may have you worried about how you’ll be able to buy a home. But, if you don’t need a ton of space, you may find you have more cost-effective options in an unexpected place: new home […]

Read More

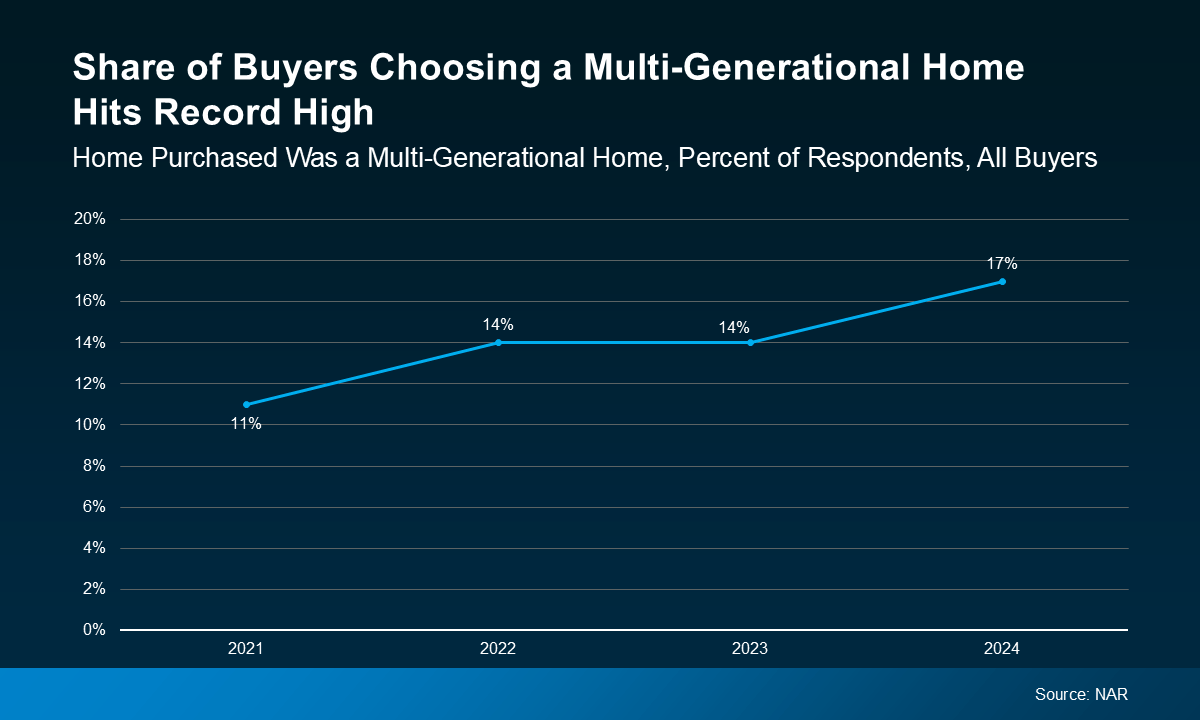

Today, 17% of homebuyers are choosing multi-generational homes — that’s when you buy a house with your parents, adult children, or even distant relatives. What makes that noteworthy is that 17% is actually the highest level ever recorded by the National Association of Realtors (NAR). But what’s driving the recent rise in multi-generational living? Top […]

Read More

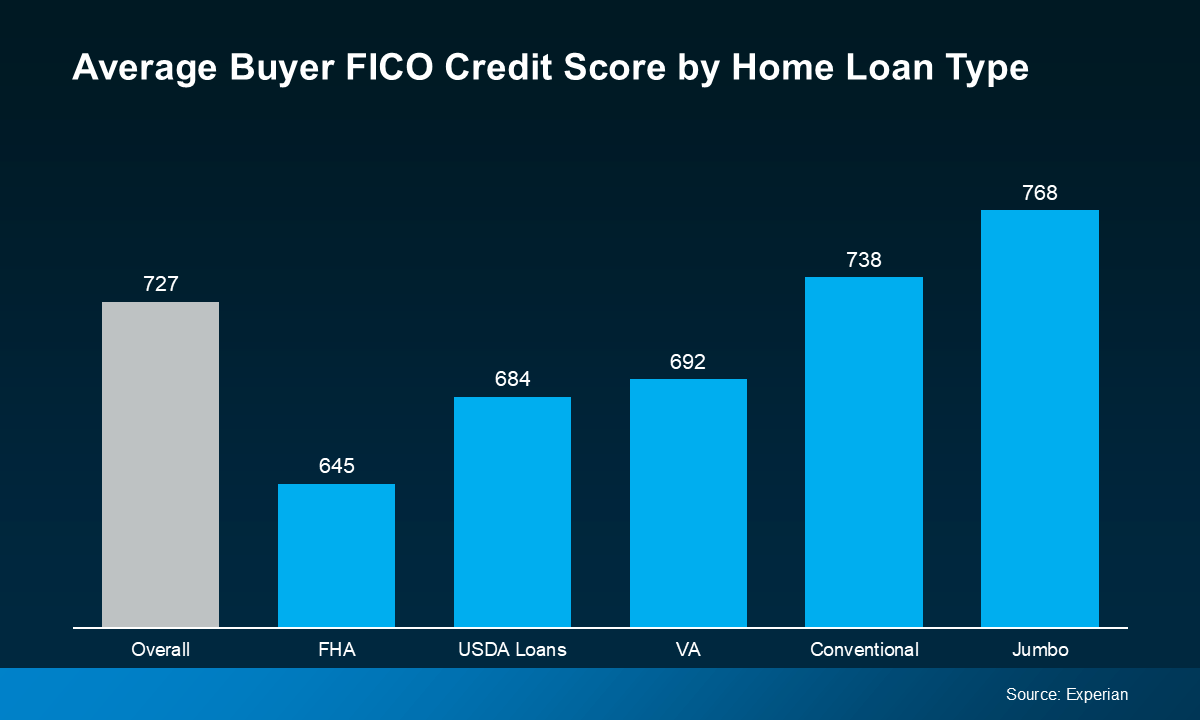

Your credit score plays a big role in the homebuying process. It’s one of the key factors lenders look at to determine which loan options you qualify for and what your terms might be. But there’s a myth about credit scores that may be holding some buyers back. The Myth: You Need To Have Perfect […]

Read More

Knowing what to budget for when buying a home may feel intimidating — but it doesn’t have to be. By understanding the costs you may encounter upfront, you can take control of the process. Here are just a few things experts say you should be thinking about as you plan ahead. 1. Down Payment Saving for […]

Read More