There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner. If you’re willing to roll up your sleeves (or hire someone who will), buying a house that needs some work could open the door to homeownership. Here’s everything you […]

Read More

A recent report from Realtor.com says 20% of Americans don’t think homeownership is achievable. Maybe you feel the same way. With inflation driving up day-to-day expenses, saving enough to buy your first home is more of a challenge. But here’s the thing. With the right resources and help, you can still make it happen. There […]

Read More

Moving to a more affordable area could be the fresh start you need to get ahead financially. While some markets are certainly more affordable than others, know that working with a trusted real estate agent to find what fits your budget and your desired location – no matter where you want to be – is […]

Read More

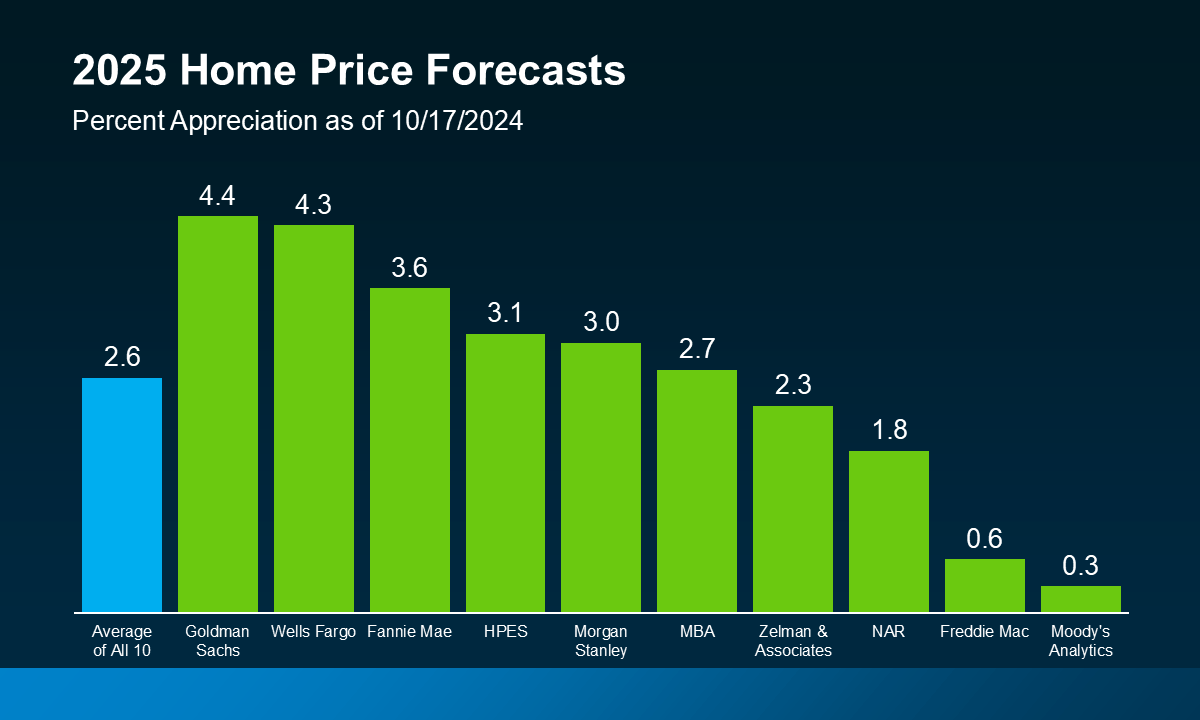

You may be wondering if home prices are going to crash. And believe it or not, some people might even be hoping this happens so they can finally purchase a more affordable home. But experts agree that’s not what’s in the cards – and here’s why. There are more people who want to buy a […]

Read More

Looking to buy a home but feeling like almost everything is out of reach? Here’s the thing. There’s still a way to become a homeowner, even when affordability seems like a huge roadblock – and it might be with a fixer upper. Let’s dive into why buying a fixer upper could be your ticket to […]

Read More

Even though there are more homes available for sale than there were at this time last year, there are still more buyers than there are houses to choose from. So, know that if you’ve got moving on your mind, your house can really stand out. There are several key reasons why there aren’t enough homes […]

Read More

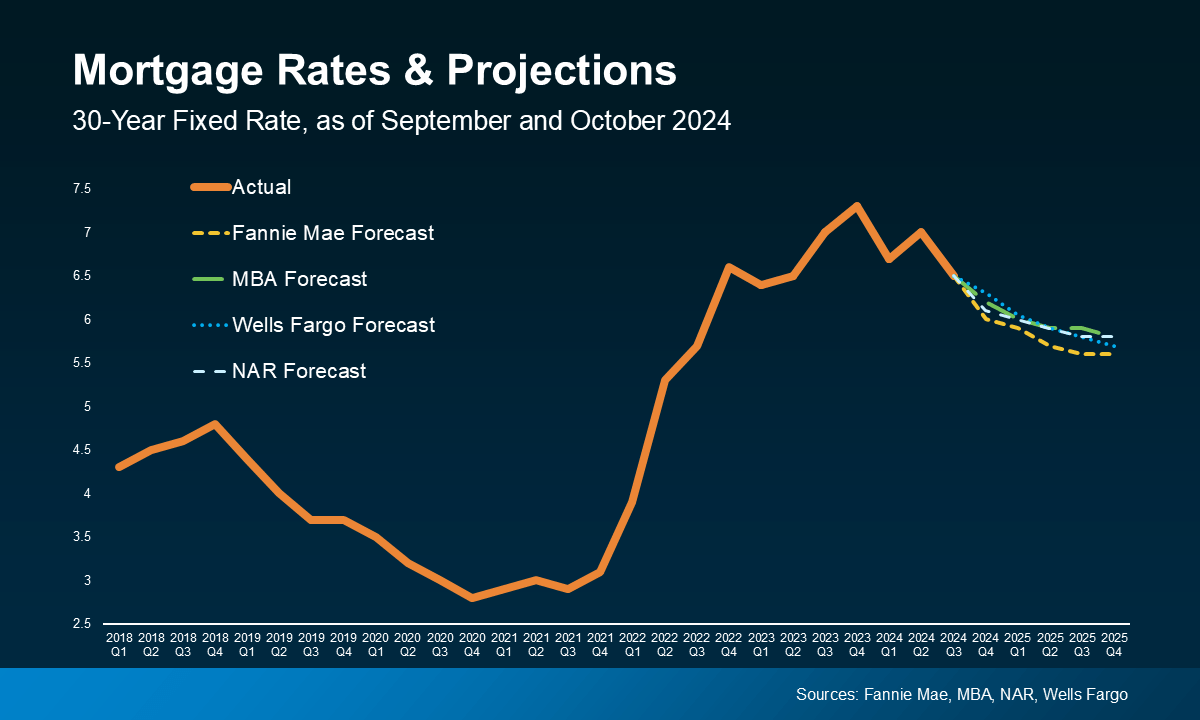

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices. Whether you’re thinking of buying or selling, here’s a look at what the experts are saying […]

Read More

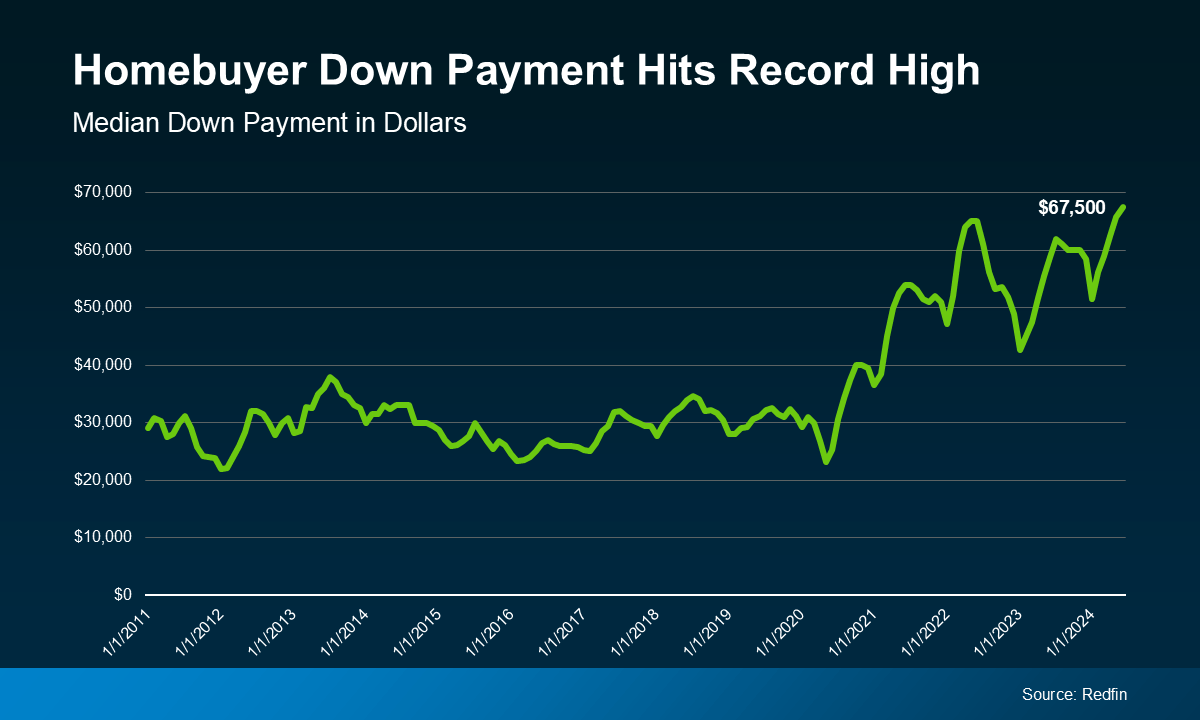

Did you know? Homeowners are often able to put more money down when they buy their next home. That’s because, once they sell, they can use the equity they have in their current house toward their next down payment. And it’s why as home equity reaches a new height, the median down payment has too. […]

Read More

Some Highlights Affordability is based on three key factors: mortgage rates, home prices, and wages. And today, it’s improving quickly as rates come down, prices level off, and wages climb. If you put your search on pause because it was too expensive to buy, connect with an agent to talk about why now may be […]

Read More

That’s right—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below): As mortgage rates have eased off their recent peak, home prices have moderated, and inventory has ticked up, affordability has improved significantly. When you add all of […]

Read More